Free Credit Analysis

- No Monthly Fees

- Pay for Results

- Start Now

Credit Repair Services, Tucson, AZ

Schedule a Free Credit Analysis

- “...my credit scores increased tremendously...”

- “...true intentions to help you...”

- “...completely changed my life...”

- “...the counseling has been great...”

- “...the best choice I ever made...”

- “...the results been amazing...”

- “...I recommend this company...”

- “...my credit scores increased tremendously...”

- “...true intentions to help you...”

- “...completely changed my life...”

- “...the counseling has been great...”

- “...the best choice I ever made...”

- “...the results been amazing...”

- “...I recommend this company...”

- “...my credit scores increased tremendously...”

- “...true intentions to help you...”

- “...completely changed my life...”

- “...the counseling has been great...”

- “...the best choice I ever made...”

- “...the results been amazing...”

- “...I recommend this company...”

Build Your Credit & Increase Your Score

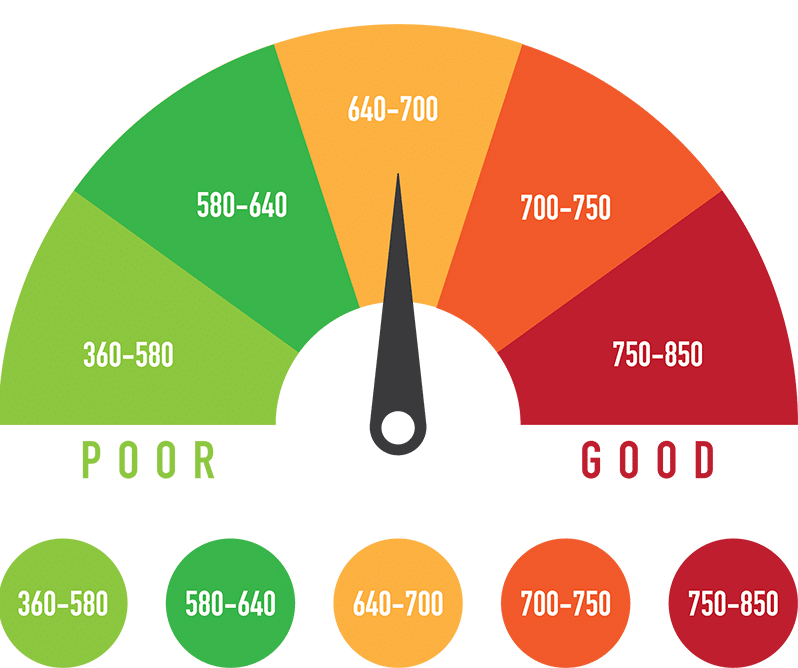

Tucson may be the sunniest city in the United States but when it comes to credit scores, the weather has been looking pretty bleak. Not unlike millions of other Americans, many residents of Tucson Arizona have seen some financially troubling times over the past decade which has led to sub-par credit scores.

Maybe it wasn’t even your fault, but the fact remains that without a high credit score, creditors are going to take advantage of you – costing you thousands. If you’re ready to get back on track to a brighter financial future, it all starts with a better, cleaner credit report. Credit Absolute will help remove negative items from your credit report which will quickly and significantly increase your credit score!

Tucson's Leading Credit Repair Company

Credit Absolute, Arizona’s top credit repair company, has helped hundreds in the Tucson area improve their credit scores and repair their bad credit. There is no longer a reason for you to suffer the consequences of having a bad credit report or low credit score. Credit Absolute can help you fix your credit quickly and at the most competitive prices while only charging you once the job is done!

What you may not know about your credit report and those of millions of other Americans like yourself is that they are notorious for having errors. Errors on a credit report could be due to clerical errors, fraud, or even simple mistypes which can be used to dispute your negative credit items. Credit Absolute will repair your credit by checking and crosschecking your credit report, finding these errors, and using them to dispute the validity of these negative items. By removing these negative items (e.g. late payments, collections, bankruptcies), Credit Absolute is able to significantly increase your credit score.

Answers To Your Questions About Credit Repair

How It Works

We will provide you with an in depth one on one credit analysis to determine your credit needs.

How Long It Takes

On average, we improve credit scores as much 40 to 100 points in 30 to 90 days.

How Much It Costs

We offer transparent, results-based credit repair pricing and services.

Take A Look At Our Latest

Articles &

Resources

August 7, 2023

A credit score is a 3 digit number that is used to determine your creditworthiness Currently more and more people…

July 25, 2022

Divorces are complicated even more so when you are tied together financially Not only are you worried about divvying up…

July 2, 2021

Identity theft is something that most of us think about at some point in our lives Unfortunately identity theft is…