Free Credit Analysis

- No Monthly Fees

- Pay for Results

- Start Now

Expert Credit Coaching: Optimize Your Scores Today!

Gain insights, improve your credit score, and navigate your credit challenges with our personalized coaching and education.

Creating Credit Approvals

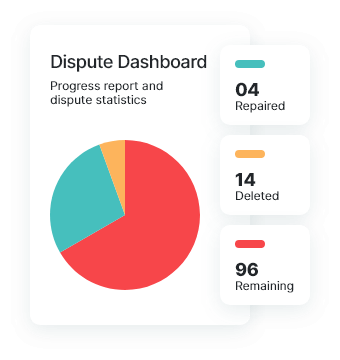

Tailored credit plans; One-on-one coaching

Lifetime membership; No monthly fees

Transparent pricing; Pay per correction

- “...my credit scores increased tremendously...”

- “...true intentions to help you...”

- “...completely changed my life...”

- “...the counseling has been great...”

- “...the best choice I ever made...”

- “...the results been amazing...”

- “...I recommend this company...”

- “...my credit scores increased tremendously...”

- “...true intentions to help you...”

- “...completely changed my life...”

- “...the counseling has been great...”

- “...the best choice I ever made...”

- “...the results been amazing...”

- “...I recommend this company...”

- “...my credit scores increased tremendously...”

- “...true intentions to help you...”

- “...completely changed my life...”

- “...the counseling has been great...”

- “...the best choice I ever made...”

- “...the results been amazing...”

- “...I recommend this company...”

Award Winning & Top Rated

Credit Repair and Counseling Service

Better Business Bureau

Accredited Business

A+ Rating

Expertise.com

Best Credit Repair

Companies in Phoenix, 2021

Business Hall of Fame

9 Consecutive Years

Best of 2023, Scottsdale

Creating Approvals

Through Education

HI! I’m Derick Vogel, Founder and CEO of Credit Absolute. We have been in business for over 10 years helping people repair their credit, get credit approvals, and make life easier financially. With over 20 years’ experience in the financial and consumer credit industry I have found that education and its application are what create financial and credit success. We aim to properly educate our clients so they can improve their credit health, scores, habits and knowledge while building a sound financial future.

10+ years of successfully turning denied applications into approvals

98%

Approved

for Auto Loans*

91%

Approved

for Home Loans*

100%

Approved

for New Credit*

98%

Approved

for Refinancing*

A Worry-Free

Personal Service

No Automated Systems. Real Experts, When You Need Them.

Understand the Credit Verification Process

In our complimentary credit review one of our credit experts will provide you with an in-depth one-on-one credit analysis to identify and determine your exact credit needs. Then we will explain the credit bureau correspondence letter process as it relates to your situation so you know how it works and what you can expect. We are optimizing credit scores in 30 to 90 days with our coaching, education and accuracy verification process.

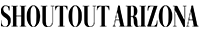

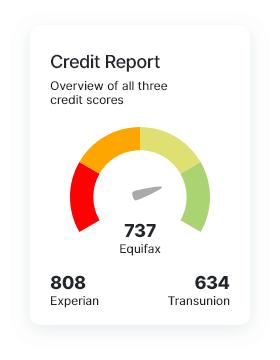

Personal Dashboard & Progress Reports

The credit bureau correspondence process is transparent with your own personal dashboard. See your results with real time updates and communications from our team. Be involved at every step of your success with 24-hour access to your personal dashboard.

Performance Based with Transparent Pricing

We are always clear on our pricing and how it works, we ensure you know how much your investment could be upon successful results. Credit Absolute is a performance-based company, our clients pay for results. We don’t believe in monthly pricing because our goal is to fix your credit as quickly and best as possible.

Education & Resources to Stay Credit Healthy

Access the best resources to handle any credit violation or credit challenge you may be faced with. We know without education its impossible to reach the ultimate goal of excellent credit. You will have access to tools, videos, library’s, simulators and much more to build and maintain your credit. This is all part of your lifetime membership when you enroll.

We're Aiming for a National Presence

Our Courage Stems from the Results We've Delivered

It's Easy to Get Started

Instant Onboarding. Great Prices.

Big Heart.

Share Your

Credit Challenges

By sharing your goals, we can identify the most efficient credit plan to maximize your credit scores and improve your credit profile.

Complete Complimentary

Credit Analysis

A 30-minute one-on-one in depth review of your entire credit report with our credit experts to ensure we reach your goals as quick as possible.

Improve

Your Credit Score

Start utilizing our tools and resources in your personal dashboard to build credit while we take care of the heavy lifting with the credit bureaus.

Schedule a Complimentary Credit

Review & Get a FREE eBook

Why You Must Get The Ebook?

Well, it's an action plan on how you can improve your credit score through a proven process and get your credit health back on track.

And, it's FREE!