Buying a home or renting is a decision each of us has to make at some point in our lives. In your 20s, renting can be the obvious option. This is a time when you are probably still weighing options on where to stay or have not yet settled into your career. Your lifestyle is best suited to renting an apartment or having a roommate to split the cost with.

Once you clock 30, your priorities change. Your career is probably on course. This is when housing needs become more important. You might even be building a family or are considering starting one. You have to make a decision on whether to continue renting or decide to buy a home. To aid you in this, let’s look at the pros & cons to buying a home vs renting.

Pros of Buying a Home

Security and freedom

Unlike a rental property, owning a home eliminates the threat of being evicted by a landlord. You get the freedom to renovate, decorate or change any aspect of your home whenever you like.

Building equity

Your home equity increases with every mortgage payment. Couple this with property appreciation and buying a home becomes a worthy investment. You can earn a profit upon selling your house. Mortgage refinancing can be of great help when making major purchases.

Income generation

As a homeowner, you can rent part of your property for some much-needed income boost. Running a home-based business is also easier when you own a house.

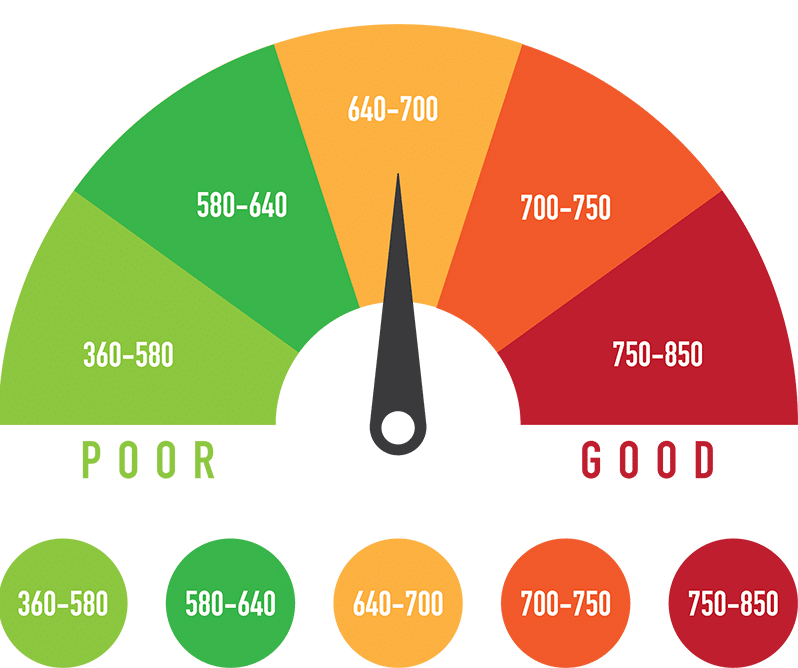

Improving your Credit Score

Timely mortgage payments factor positively on your credit reports. This sets you up for better rates on other lines of credit that you may require in the future.

Cost Effective

Tax deductions on mortgage interests will save you money. Same goes for tax deductions on income generated within your property.

Cons of Buying a Home

Ownership Costs

Owning a home comes with added costs. These include homeowner’s association payments, property taxes and rates, and maintenance costs.

Less Mobility

Moving from one state or location to another becomes difficult when you are a homeowner; especially if the move is dependent on selling your property. Selling can also be time-consuming.

High Interest

Factors such as location and the state of the economy can drive up interest rates on mortgages. This will increase the overall cost of ownership. At the same time, if yours is an adjustable rate mortgage (ARM), expect upward fluctuations on the monthly payments.

Possible Loss on Resale

One of the driving ideas for buying a home is that it’s an investment. However, making a profit upon selling is not a guarantee. Property value can drop drastically due to factors like recession that are beyond your control. Resale also comes with additional costs such as government and agent fees that will cut down on expected profits.

Pros of Renting

Flexibility

Staying in one place can be restrictive. This may be due to frequent job relocations. As a tenant, all you need to vacate is mostly a month notice to the landlord or lease expiry. This makes renting more flexible compared to owning a home which may require a lengthy process to offload the property.

Low Housing Costs

Apart from rent, a tenant bears no other financial obligation to the property. Utility bills are usually covered by the rent as well as maintenance costs. While one may have to insure their belongings, the cost pales in comparison to a homeowner’s insurance.

Investment Diversity

Renting leaves most of your current earnings available for investments. This is in contrast to buying a home which means most of your income goes towards one investment.

Cons of Renting

Less Freedom

The tenancy comes with rules that can be restrictive. Your ability to renovate or even decorate can be subject to disapproval by the building management. Some landlords may not even allow pets in their property.

Slow Maintenance

Not having to carry out maintenance is a plus on renting but it comes with its challenges. Issues to do with your ‘house’ have to go through building managers or rental agents who are never in a hurry to solve them. In some cases, a leaking faucet can take months to be fixed.

Lease Limitations

Most lease agreements have an annual increase clause of 5-10% on monthly payments. You also have little or no say when it comes to lease renewal. These can leave you looking for an apartment at the end of every lease term or year.

Not Owning

There is prestige that comes with owning anything of value; renting denies you this. Your monthly payments go towards the landlord’s loans and savings as opposed to paying for your own home with a mortgage.

Conclusion

In the long run, buying a home is the cheaper option. It’s also a plus on your long-term investments. However, it comes with more obligations. On the other hand, renting is more flexible. It also frees up more of your income which can go to savings. With this info at your fingertips, you are bound to make the choice that best suits you.